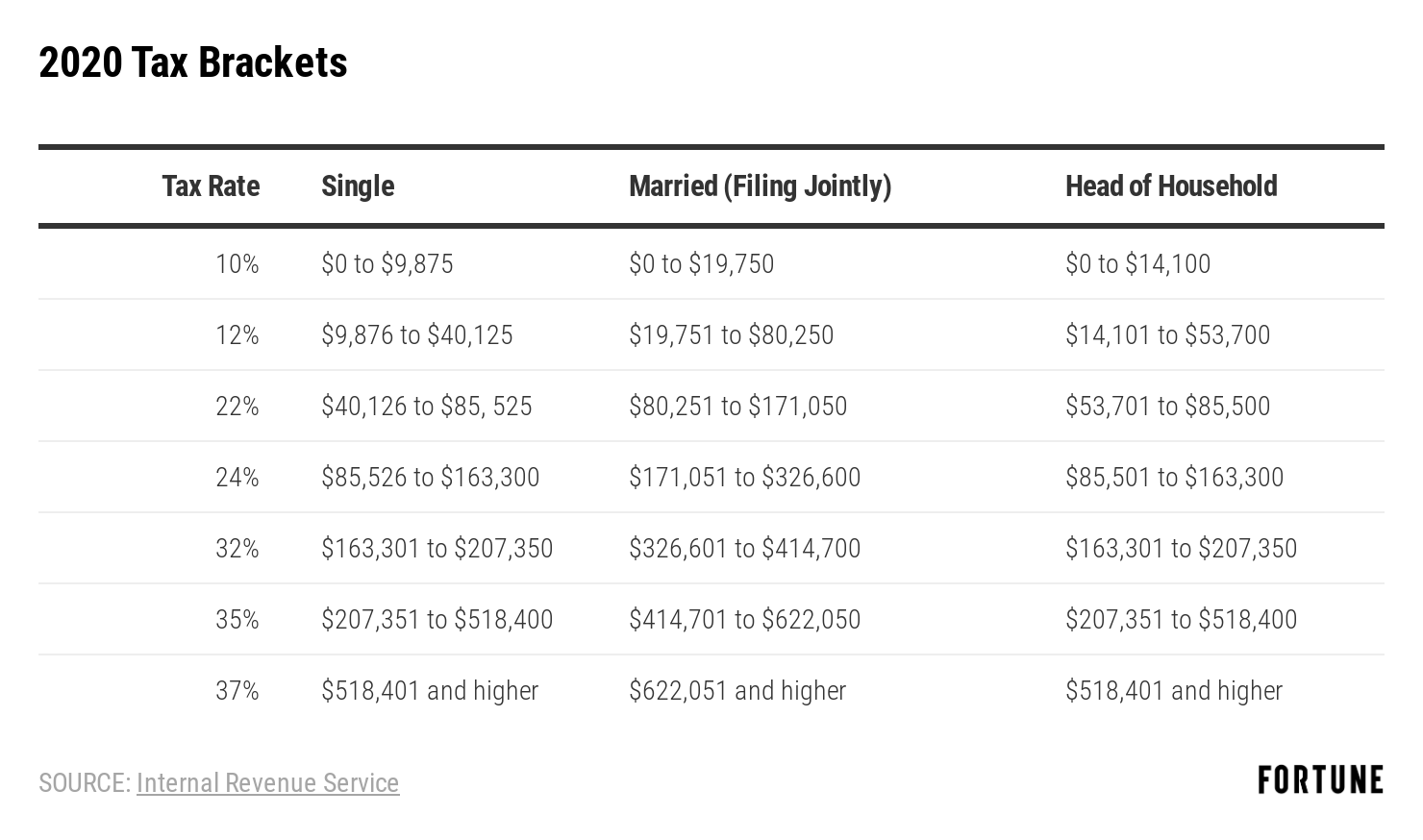

In the most recently available income data, only 133,137 households that made over a million dollars. That means you have to earn nearly $2.9 million dollars before you would ever pay a 94% tax rate on a single dollar of income. So when Alexandria Ocasio-Cortez, United States Representative from New York, floated the idea of a top tax bracket of 70%, it doesn’t mean the highest-earning taxpayers will pay 70% on all of their income.īack in 1944, during World War 2, the top tax bracket was 94% and applied to income over $200,000. That’s your total income minus deductions. And these taxes are assessed on your adjusted gross income. The 100,000th dollar is taxed more than your 1st dollar. Every dollar you earn is not taxed the same. This means that you are taxed at a higher rate when you earn more. So how do the tax brackets and deductions work? Table of Contentsįederal income tax is a progressive tax system. There are other credits and deductions that automatically change based on the Consumer Price Index released by the Bureau of Labor Statistics. They are not pegged to inflation or cost of living, but the IRS “manually” adjusts them every year to account for them. The brackets and the deductions (standard and itemized) are the two values that tend to change from year to year. Today, we will explain away one piece of the tax puzzle – the federal tax brackets. Even if you knew every last deduction (and that would make you a tax accountant or a weirdo!), you’d still only know half the story. You have deductions, credits, exemptions, carryovers, … the list goes on and on. What’s always tricky about taxes in the United States is how complicated they are to understand. That was my lovely introduction to taxes. I had probably six shifts a week? So I had expected my first paycheck to be a little over $150 (this place deducted an amount for “food,” assuming you’d eat something there… which was a scam because no one ate anything during their shift, you were too busy!)) but it was just over $100 after withholding and FICA. The banquets were only a few years so the paycheck was around $30 a shift. I was working at a restaurant as a banquet waiter earning something around minimum wage in New York in the late 90s.

0 kommentar(er)

0 kommentar(er)